Stop Financial Stress: How to Master Saving & Spending

Financial Discipline: Saving and Spending with Intention (Ase)

Money is more than paper, coins, or numbers on a screen. In Ifa, money is considered ase in motion—a force that amplifies whatever path you choose. Managed with wisdom, it brings peace and stability. Handled without intention, it creates chaos, stress, and imbalance.

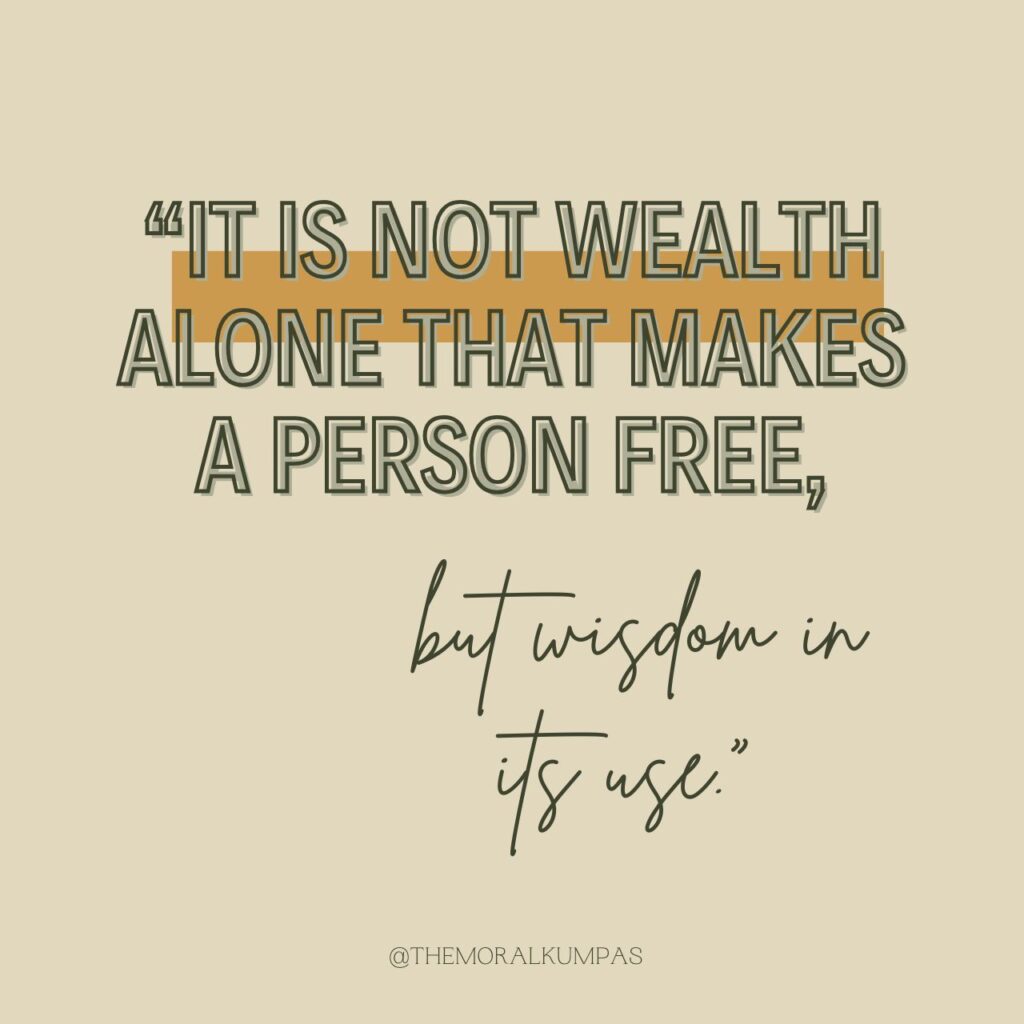

The Odù Irete Owónrin reminds us: “It is not wealth alone that makes a person free, but wisdom in its use.” That’s financial discipline in a nutshell: the wisdom to save, spend, and allocate resources in ways that align with your destiny.

Let’s explore how to practice financial discipline with intention through saving, spending, and the mindset that binds it all together.

But, before we dive in, make sure you grab your access to my free weekly sneak peak of The Weekly Flow subscription to stay disciplined and to discover new strategies then come back and finish this guide!

1. Saving: The Foundation of Security and Freedom

Ifa In the Odù Osa Meji, Ifa teaches that the one who prepares avoids unnecessary hardship. Savings are your preparation for life’s unknowns.

Without savings, even small surprises—like a car repair or medical bill—become crises. With savings, you gain peace of mind and the freedom to make choices without fear.

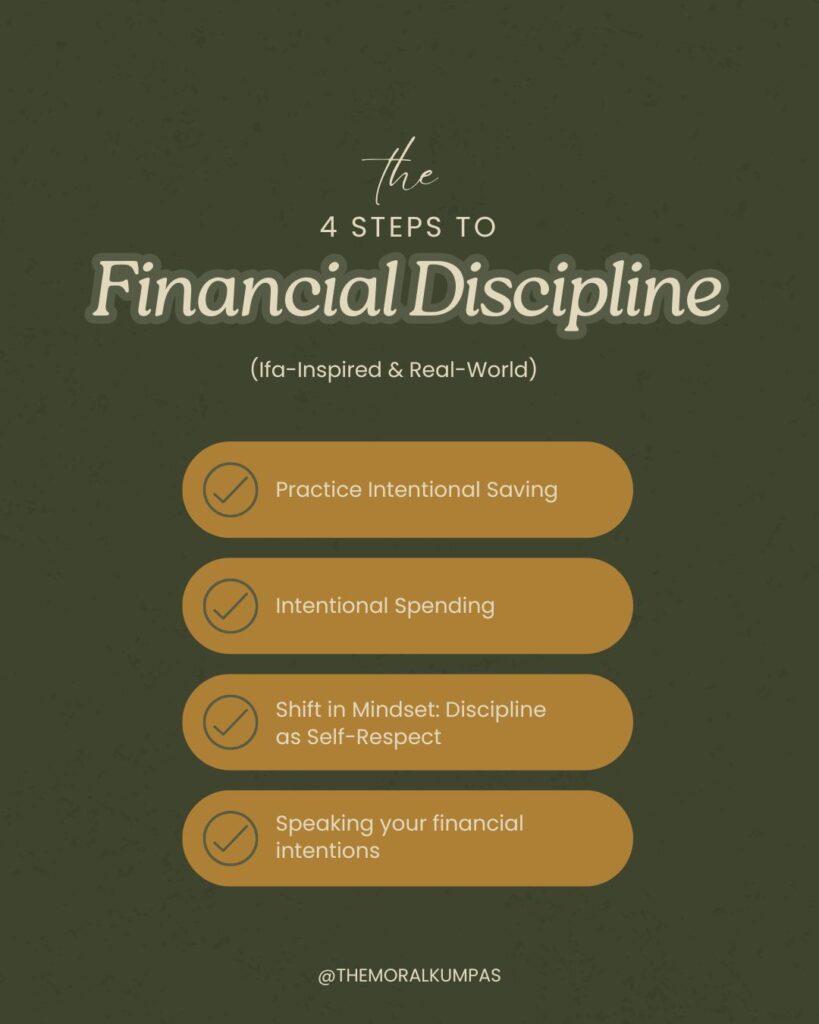

Steps to Practice Intentional Saving:

- Start with percentages, not perfection. Even if you can only save 5%, it builds momentum. Discipline grows with consistency.

- Separate your accounts. Keep savings out of your checking account to avoid temptation.

- Name your savings. Call it “Future Peace,” “Emergency Cushion,” or “Freedom Fund.” This ties the money to purpose, not just numbers.

- Automate it. Remove decision fatigue by setting up an auto-transfer on payday.

Ifa’s lesson here: Saving is honoring your future ori (inner head/self). You are showing respect to the version of you who will live tomorrow

2. Spending: Directing Energy with Intention

TThe Odù Oyeku Meji teaches us that every action carries consequence. In money terms, every swipe, tap, or dollar bill is an energetic choice. Spending is not just consumption—it’s directing your life energy.

Steps to Practice Intentional Spending:

- Pause before purchase. Ask: “Does this bring me joy now or peace later?” If it does neither, it’s not worth it.

- Track your leaks. For one month, write down every expense. Patterns emerge: coffee habits, impulse buys, unused subscriptions. These are where energy slips away.

- Prioritize values, not vanity. Spend on what aligns with your purpose, not what pleases the crowd.

- Budget with flexibility. A budget is not punishment—it’s a plan for freedom. Build in joy (like dining out, hobbies, or treats) so you don’t rebel against your own system.

Ifa’s lesson here: Money should serve you, not enslave you. When you spend with awareness, you move in harmony, not compulsion.

3. The Mindset: Discipline as Self-Respect

Financial discipline is often framed as sacrifice. But in Ifa, discipline is never punishment—it’s alignment.

The Odù Ika Ofun teaches: “The person who honors themselves today walks freely tomorrow.” Savings and spending discipline are ways of honoring yourself—protecting your peace, stability, and dignity.

Shift in Mindset:

From money as stress to money as ally. When managed intentionally, money becomes a tool of support, not anxiety.

From deprivation to empowerment. Instead of “I can’t spend,” reframe it as “I choose to direct my ase where it matters most.”

From short-term pleasure to long-term freedom.

Remember: the joy of freedom lasts longer than the thrill of impulse.

4. Ase: The Power of Spoken and Lived Intention

In Ifa, ase is the authority to bring words, thoughts, and actions into alignment. This same principle applies to money.

- When you declare: “I save to secure my peace,” your behavior aligns.

- When you affirm: “I spend only on what aligns with my purpose,” your choices follow.

Try speaking your financial intentions before spending or saving:

- “This saving protects my future.”

- “This purchase supports my growth.”

- “This expense does not serve me, so I release it.”

Your words create alignment. Your alignment creates freedom.

Final Thought: Balance, Not Perfection

Ifa teaches balance above all things. Financial discipline isn’t about hoarding wealth or cutting out every pleasure. It’s about balance—creating a flow where money supports your values, not your impulses.

- Save with purpose.

- Spend with clarity.

- Align your mindset with intention.

That’s how you build freedom and peace, not just wealth. Ase.

Explore more Ifa-inspired mindset tools in the Mindset & Clarity (Èrò) Library.

Ready for practical, weekly guidance?

Join The Weekly Flow — your Ifa-inspired roadmap to stay centered, structured, and consistent.